Budget travelers in India can secure comprehensive travel insurance starting from ₹8-22 per day. Top budget-friendly options include ACKO (₹8/day), ICICI Lombard (₹22/day), Bajaj Allianz (₹13/day), and Tata AIG (₹24.8/day), offering essential coverage for medical emergencies, trip cancellations, and baggage loss with sum insured ranging from $50,000 to $500,000.

Travel insurance has become an essential companion for budget-conscious travelers, providing financial protection without straining your wallet. With the rise in international travel among Indians and increasing awareness of potential travel risks, finding affordable yet comprehensive coverage has never been more critical.

Why Budget Travelers Need Travel Insurance

Budget travelers often face unique challenges that make travel insurance even more essential. Limited financial reserves mean unexpected expenses abroad can quickly derail entire trips or create long-lasting financial hardship. A medical emergency in countries like the United States, where hospital costs can exceed $1,000 per day, could result in bills worth lakhs.

According to industry data, medical treatment costs abroad are typically 3-5 times higher than in India, making travel insurance not just advisable but financially prudent. Even budget destinations can present expensive medical scenarios – a simple fracture treatment in Thailand might cost ₹50,000-80,000, while emergency evacuation from remote locations can cost over ₹10 lakhs.

Top Budget Travel Insurance Providers in India

1. ACKO Travel Insurance – Ultra Budget Option

Starting Premium: ₹8 per day

Coverage Range: $50,000 – $500,000

Key Features:

- Zero deductibles on most claims

- Comprehensive adventure sports coverage

- Digital-first platform with instant policy issuance

- Flexible coverage options allowing customization

ACKO stands out for extremely competitive pricing without compromising essential coverage. Their basic plan at ₹49 for 5 days (₹8/day) covers medical emergencies, trip cancellations, and baggage delays. The company’s digital-first approach eliminates intermediary costs, passing savings to customers.

Budget-Friendly Highlights:

- Fixed payouts for flight delays (no bill submission required)

- Covers adventure sports injuries (often excluded by competitors)

- No additional charges for consumables during hospitalization

- Instant claim settlement through mobile app

2. ICICI Lombard Travel Insurance – Comprehensive Budget Coverage

Starting Premium: ₹22 per day

Coverage Range: $50,000 – $1,000,000

Key Features:

- Extensive global cashless hospital network

- No medical examination required

- COVID-19 coverage included

- 24/7 customer support

ICICI Lombard offers robust coverage starting at ₹22 per day, making it accessible for budget travelers while providing comprehensive protection. Their wide cashless hospital network ensures immediate medical care without upfront payments.

Customer Experience: Reviews indicate generally positive claim settlement experiences, though some customers report delays in non-medical claims like baggage loss.

3. Bajaj Allianz Travel Insurance – Value for Money

Starting Premium: ₹13 per day

Coverage Range: $50,000 – $1,000,000

Key Features:

- Modular plan design for customization

- Pre-existing disease coverage up to $3,000

- 10% group discount for 2+ travelers

- Direct online purchase discount of 5%

Bajaj Allianz provides excellent value with plans starting at ₹13 per day. Their modular approach allows budget travelers to select only essential coverages, reducing overall costs.

Family Budget Options:

- Standard Plan: Starting ₹308 (individual)

- Family Plan: Starting ₹1,470 (family of 4)

- Additional benefits like golfer’s hole-in-one and extended pet stay

4. Tata AIG Travel Insurance – Reliable Budget Choice

Starting Premium: ₹24.8 per day

Coverage Range: $50,000 – $1,000,000

Key Features:

- Quick policy purchase process

- Higher sum insured options up to $1,000,000

- Visa-compliant plans for all destinations

- 24/7 global customer assistance

Tata AIG offers competitive rates starting at ₹24.8 per day with comprehensive coverage options. Their plans are carefully designed to meet visa requirements for various countries.

Recent Performance Concerns: Some customer reviews indicate claim settlement challenges, particularly for non-medical claims like missed flights due to technical issues.

5. HDFC ERGO Travel Insurance – Mid-Budget Excellence

Starting Premium: ₹31 per day

Coverage Range: $40,000 – $1,000,000

Key Features:

- 100,000+ cashless hospitals worldwide

- Coverage for 43 countries including all Schengen nations

- No health check-up required

- COVID-19 hospitalization coverage

HDFC ERGO’s Explorer plan starting at ₹31 per day offers comprehensive coverage with excellent customer support. Their tiered approach (Silver, Gold, Platinum) allows budget optimization.

6. Niva Bupa Travel Insurance – Premium Budget Option

Starting Premium: ₹20 per day

Coverage Range: Up to $500,000

Key Features:

- Coverage for 190+ destinations

- Pre-existing disease coverage up to $2,500

- COVID-19 coverage up to sum insured

- 10% group discount for 2+ members

Niva Bupa offers competitive pricing at ₹20 per day while providing extensive coverage. Their focus on comprehensive medical protection makes them ideal for health-conscious budget travelers.

Budget Travel Insurance Comparison Table

| Provider | Daily Rate | Sum Insured Range | Key Advantages | Best For |

|---|---|---|---|---|

| ACKO | ₹8-15 | $50K-$500K | Zero deductibles, adventure sports | Ultra-budget backpackers |

| Bajaj Allianz | ₹13-25 | $50K-$1M | Modular plans, group discounts | Families, customizable needs |

| Niva Bupa | ₹20-35 | Up to $500K | Extensive destinations, PED coverage | Health-focused travelers |

| ICICI Lombard | ₹22-40 | $50K-$1M | Large hospital network | Mainstream budget travel |

| Tata AIG | ₹24.8-50 | $50K-$1M | Visa compliance, quick purchase | First-time international travelers |

| HDFC ERGO | ₹31-60 | $40K-$1M | Comprehensive benefits | Mid-range budget travelers |

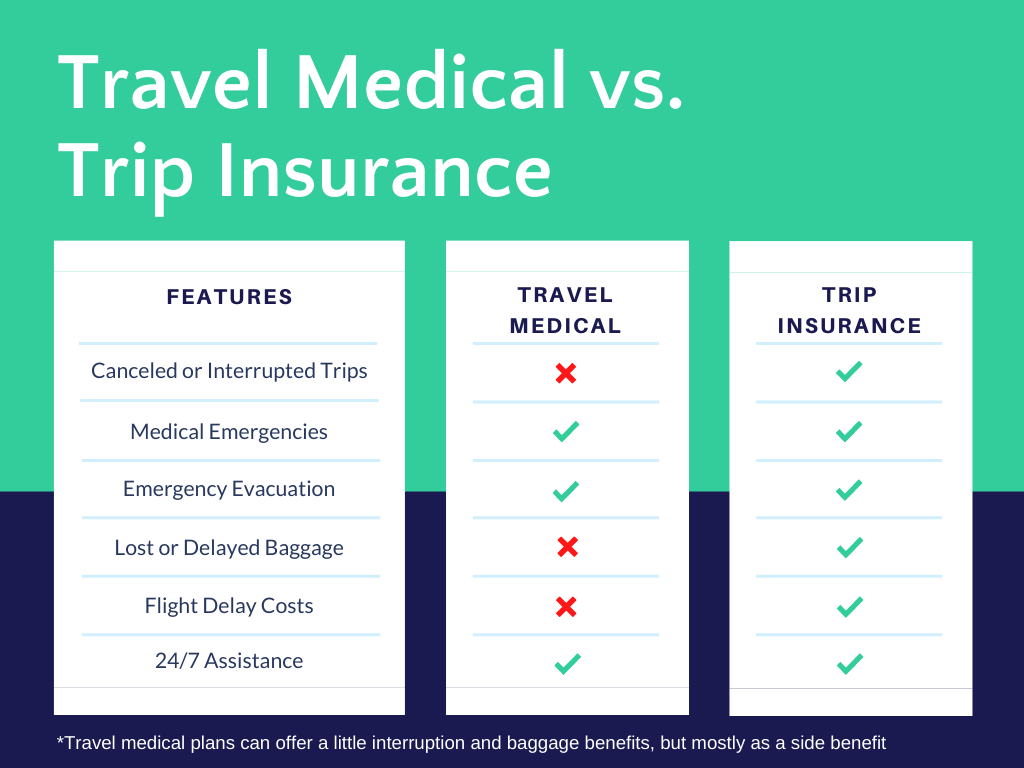

Essential Coverage for Budget Travelers

Medical Emergency Coverage

Budget travelers should prioritize medical coverage as the primary protection. Minimum recommended coverage:

- Asia (excluding Japan): $50,000-$100,000

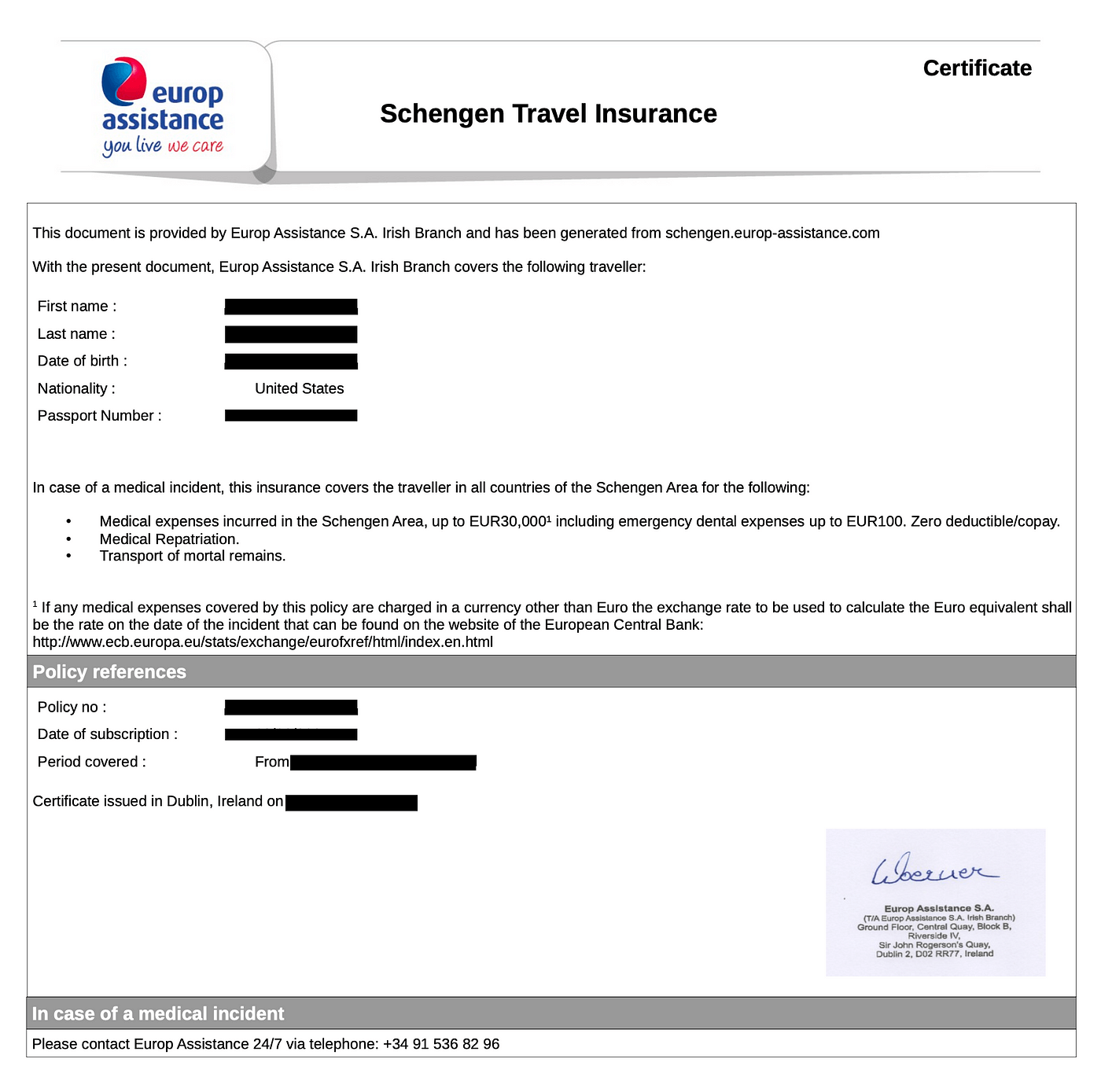

- Europe/Schengen: $30,000 (minimum visa requirement), recommended $100,000+

- USA/Canada: $200,000-$500,000

- Australia/New Zealand: $100,000-$200,000

Trip Cancellation and Interruption

Essential for protecting non-refundable bookings. Budget travelers often book advance-purchase, non-refundable tickets to save money, making this coverage crucial. Look for policies covering cancellation due to:

- Medical emergencies (self or family)

- Natural disasters

- Terrorism at destination

- Job loss or business reasons

Baggage and Personal Effects

Budget travelers typically carry valuable electronics and essential items. Ensure coverage includes:

- Lost, stolen, or damaged luggage

- Delayed baggage compensation

- Personal electronics (laptops, cameras, phones)

- Travel documents (passport, visa replacement costs)

Budget-Specific Coverage Considerations

Adventure Sports Coverage

Many budget travelers engage in adventure activities. Standard policies often exclude:

- Bungee jumping

- Skydiving

- Scuba diving (beyond recreational depths)

- Mountaineering

- Skiing/snowboarding

ACKO provides comprehensive adventure sports coverage in their standard plans, making them ideal for adventure budget travelers.

Pre-existing Medical Conditions

Budget travelers with pre-existing conditions should consider:

- Niva Bupa: Up to $2,500 for emergencies

- Bajaj Allianz: Up to $3,000 for emergency care

- HDFC ERGO: Coverage available with declaration

COVID-19 Coverage

Post-pandemic essential coverage includes:

- COVID-19 treatment and hospitalization

- Quarantine accommodation costs

- Trip cancellation due to COVID-19

- Emergency evacuation due to outbreak

All major providers now include COVID-19 coverage as standard.

Money-Saving Tips for Budget Travelers

1. Multi-Trip vs Single Trip Policies

Single Trip: Cost-effective for occasional travelers (1-2 trips per year)

Multi-Trip Annual: Better value for frequent travelers (3+ trips per year)

Annual multi-trip policies can save 30-50% for frequent travelers, covering unlimited trips up to specified days per trip.

2. Group Policies and Family Plans

- Bajaj Allianz: 10% discount for 2+ travelers

- Niva Bupa: 10% discount for 2+ members

- Family floater plans: Often 20-30% cheaper than individual policies

3. Online Purchase Discounts

- Bajaj Allianz: 5% direct online discount

- Most providers: 5-10% savings vs agent purchases

- Early booking: Some providers offer discounts for advance purchases

4. Coverage Optimization

- Choose destination-appropriate sum insured

- Skip unnecessary add-ons

- Consider higher deductibles for lower premiums

- Select essential coverage only for ultra-budget trips

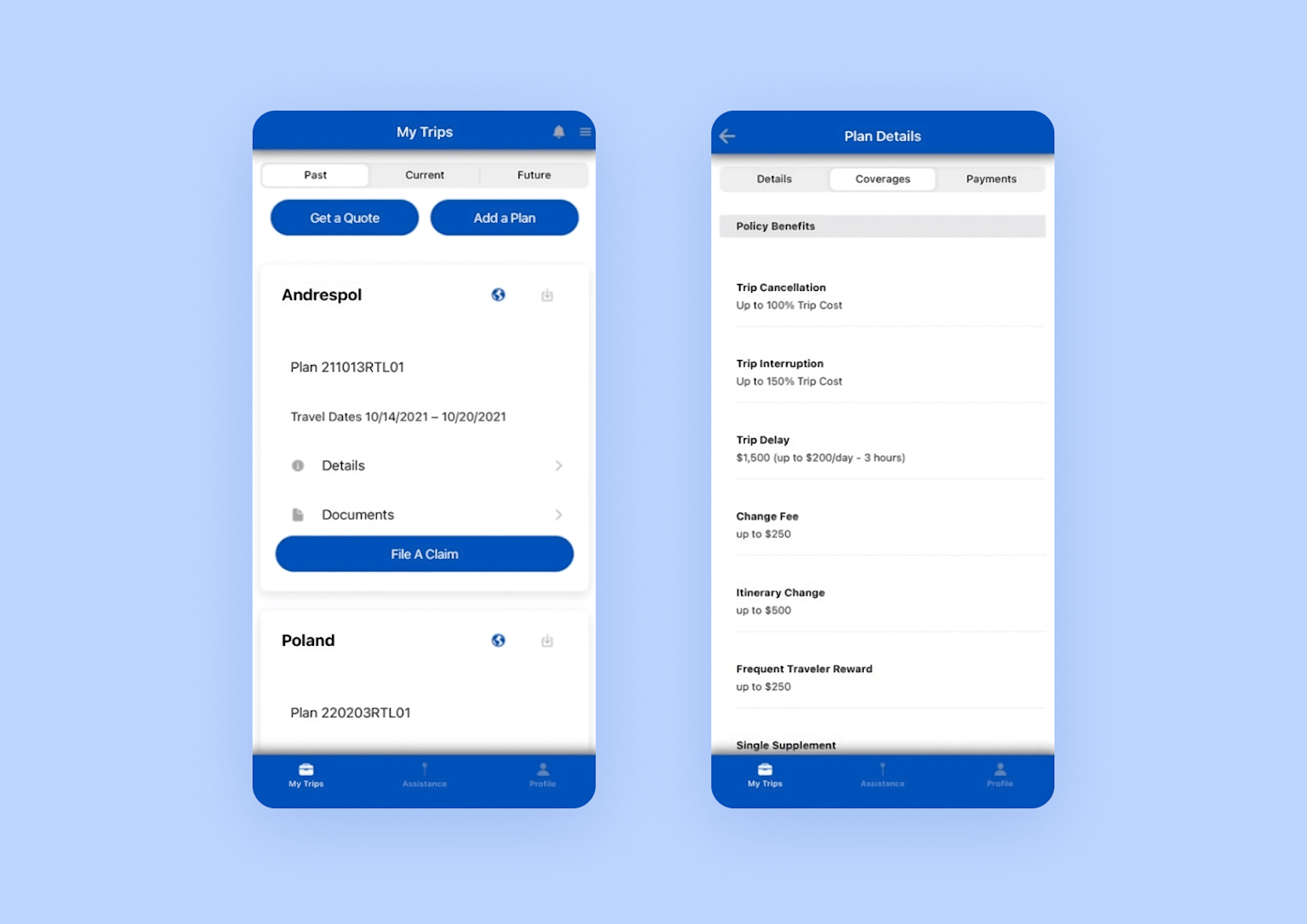

Claim Process and Customer Experience

Digital Claim Processes

Modern insurers offer smartphone-based claim filing:

- ACKO: Completely digital, instant claim status updates

- ICICI Lombard: Mobile app with document upload

- Bajaj Allianz: WhatsApp-based claim assistance

- HDFC ERGO: Online claim portal with 24/7 tracking

Required Documentation

Budget travelers should maintain:

- Policy documents (digital copies)

- Medical bills and treatment records

- Police reports (for theft/loss)

- Airline/hotel confirmations

- Receipts for all claim-related expenses

Claim Settlement Timeframes

- Medical emergencies: 7-15 days (post-documentation)

- Baggage claims: 15-30 days

- Trip cancellation: 15-45 days

- Cashless medical: Immediate (pre-approved cases)

Special Categories of Budget Travelers

Student Travel Insurance

Students traveling for education need specific coverage:

- Study interruption benefits

- Sponsor protection coverage

- Extended duration policies

- Lower premiums for age group

Best Options:

- Bajaj Allianz: Student-specific plans from ₹624

- HDFC ERGO: Student travel insurance with academic benefits

- Tata AIG: Education-focused coverage options

Senior Citizen Travel Insurance

Travelers aged 60+ face higher premiums but can still find budget options:

- Age restrictions: Most policies cover up to 70 years

- Higher medical coverage recommended

- Pre-existing condition coverage essential

Senior-Friendly Options:

- Bajaj Allianz: Super Age plan for 70+ years

- HDFC ERGO: Coverage up to 70 years with medical caps

- Care Insurance: Specific senior citizen benefits

Family Travel on Budget

Family travelers can optimize costs through:

- Family floater policies (single policy covering all members)

- Child-specific benefits (educational trip coverage)

- Group discounts (typically 10% for families)

Common Exclusions to Avoid

Activities and Sports Exclusions

- Extreme sports (unless specifically covered)

- Professional sports participation

- Racing (motor, horse, boat)

- Military service activities

Medical Exclusions

- Cosmetic procedures

- Routine health check-ups

- Pregnancy-related costs (unless emergencies)

- Mental health treatment (some policies)

- Substance abuse-related incidents

Travel-Related Exclusions

- Travel to war zones or high-risk areas

- Government travel advisories against destination

- Unlicensed transportation use

- Violation of local laws

Regional Considerations and Visa Requirements

Schengen Visa Requirements

European travel requires minimum €30,000 (approximately ₹27 lakhs) medical coverage. Budget options:

- ACKO Schengen: Starting ₹49 for 5 days

- Bajaj Allianz Europe: Comprehensive Schengen compliance

- HDFC ERGO Europe: Meets all visa requirements

Asia-Pacific Travel

Lower medical costs allow reduced coverage:

- Thailand/Malaysia: $50,000-$100,000 sufficient

- Singapore/Japan: $100,000+ recommended

- Australia/New Zealand: $200,000+ for higher medical costs

Americas Travel

Higher medical costs require substantial coverage:

- USA/Canada: $200,000-$500,000 minimum recommended

- Central/South America: $100,000-$200,000 adequate

- Emergency evacuation: Critical for remote areas

Key Takeaways

- Budget travel insurance starts from ₹8 per day with comprehensive coverage options available for every budget range

- ACKO offers the most competitive rates with zero deductibles, while Bajaj Allianz provides excellent customization options

- Essential coverage should include medical emergencies (minimum $50,000-$100,000), trip cancellation, and baggage protection

- Digital-first insurers like ACKO provide faster claim processing and better customer experience for tech-savvy travelers

- Annual multi-trip policies can save 30-50% for frequent travelers taking 3+ trips per year

- COVID-19 coverage is now standard across all major providers, but adventure sports coverage varies significantly

- Group and family policies offer substantial discounts (10% typically) for multiple travelers

- Choose destination-appropriate sum insured to optimize costs – higher for USA/Europe, moderate for Asia-Pacific

- Pre-existing medical conditions require specific attention with providers like Niva Bupa and Bajaj Allianz offering better coverage

Frequently Asked Questions

Q1: What is the cheapest travel insurance for budget travelers in India?

A1: ACKO offers the cheapest travel insurance starting at ₹8 per day with basic coverage. For a 5-day trip, their plan costs just ₹49, covering medical emergencies up to $50,000, trip cancellations, and baggage delays. However, consider coverage adequacy alongside cost – sometimes paying ₹13-22/day for Bajaj Allianz or ICICI Lombard provides better value.

Q2: How much medical coverage should budget travelers choose for international trips?

A2: Medical coverage requirements vary by destination: Asia (excluding Japan) needs $50,000-$100,000, Europe requires minimum €30,000 ($30,000) for Schengen visa with $100,000+ recommended, USA/Canada should have $200,000-$500,000 due to high medical costs, and Australia needs $100,000-$200,000. Budget travelers should not compromise on medical coverage as it’s the primary protection.

Q3: Which travel insurance companies offer the best claim settlement experience for budget plans?

A3: ACKO and HDFC ERGO receive consistently positive reviews for claim settlement. ACKO’s digital-first approach provides instant claim status updates and zero deductibles, while HDFC ERGO offers 24/7 claim assistance with extensive cashless hospital network. Avoid companies with recent negative claim experiences like some Tata AIG customer complaints.

Q4: Do budget travel insurance plans cover COVID-19 and adventure sports?

A4: Most providers now include COVID-19 coverage as standard, including treatment, quarantine costs, and trip cancellation due to COVID-19. However, adventure sports coverage varies significantly – ACKO includes comprehensive adventure sports coverage in standard plans, while others may exclude or charge extra. Always check policy wordings for specific activity coverage.

Q5: Is annual multi-trip insurance better than single-trip for budget travelers?

A5: Annual multi-trip insurance becomes cost-effective if you take 3+ international trips per year. It can save 30-50% compared to individual trip policies and covers unlimited trips up to specified days per trip (typically 30-180 days). For occasional travelers (1-2 trips/year), single-trip policies remain more economical. Consider your travel frequency and calculate total annual costs for comparison.

Sources

- ICICI Lombard – Buy Travel Insurance Policy Online in India 2025 @ ₹22/day

- HDFC ERGO – Buy Travel Insurance Policy online in India 2025 @ Rs 31

- Niva Bupa – Buy Travel Insurance Policy Online in India

- ACKO – Buy Travel Insurance Online in India 2025 @ ₹8*/day

- Bajaj Allianz – Buy Travel Insurance Policy Online in India 2025 @ ₹13/day*

- Tata AIG – Tata AIG Travel Insurance Review

- HDFC Bank – Bajaj Allianz Individual Travel Insurance

- PB Partners – Top Travel Insurance Plans for Your Summer Vacation 2025

- Reddit – Advice on Travel Insurance Claim (TATA AIG Travel Guard)

- Bajaj Allianz – Best Family Travel Insurance starting ₹13/day

- Tata AIG – Travel Insurance Policy in India 2025 – Buy Online @ ₹24.8

- YouTube – Travel Insurance – BAD Experience | TATA AIG

- Bajaj Allianz – Individual Travel Insurance Plan

- Reliance General – Buy Travel Insurance Policy Online in India 2025

- Tata AIG – Buy International Travel Insurance Online

- Bajaj Allianz – Buy International Travel Insurance Policy Online

- Trustpilot – Read Customer Service Reviews of tata-aig.com

- Bajaj Allianz – Travel Insurance for Australia Online from India

- MouthShut – Tata AIG General Insurance Reviews

- Bajaj Allianz – Travel Insurance Premium Calculator